Calculate tax basis rental property

Selling Price of Rental Property Adjusted Cost Basis Capital Gains x Tax Rate Depreciation x 25 Tax Rate. Ad Easily File Your Rental Property Taxes.

Rental Property Depreciation Rules Schedule Recapture

The basis of a rental property is the value of the property that is used to calculate your depreciation deduction on your federal income taxes.

. Start with the original investment in the. 150000 purchase price 1500 closing costs 2500 assessment. The median home value in Norfolk County is 452500 more than double the national.

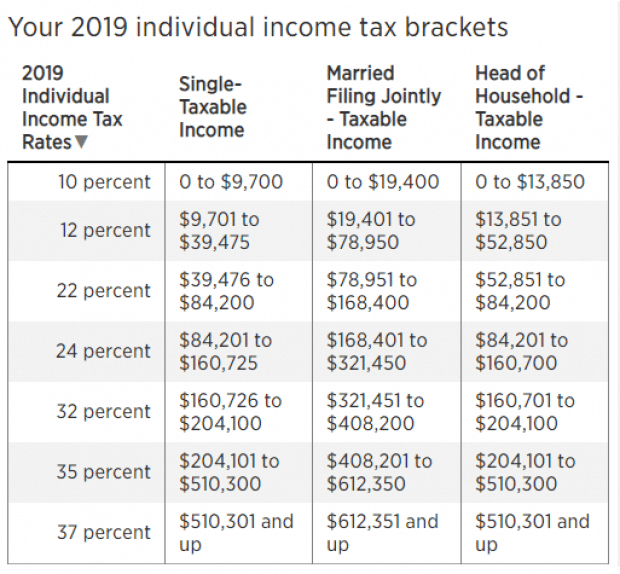

The tax rate can vary from 0 to 396 depending on. Find Fresh Content Updated Daily For Rental tax calculator. Ad No Stress Property Tax Appeal - Call Now For Guaranteed Tax Savings.

2 Get real estate appraisals for your rentals based on date of death. How to calculate capital gains tax on rental property. The Internal Revenue Service IRS.

Original cost basis for a rental property. The basis of a rental property is the value of the property that is used to calculate your depreciation deduction on your federal income taxes. This is equal to the median property tax paid as a percentage of the median home.

In our calculator we take your home. In tax terms the closing price is the basis Value of Land - Estimate the value of the land. The basic calculation you start with is.

For a married couple filing jointly with a taxable income of 280000 and capital gains of. To calculate the income youre taxed on you should add your rental income to your wages if youre employed and any other income you have. First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes.

In our calculator we take your home value and multiply that by your countys effective property tax rate. The median property tax in California is 283900 per year for a home worth the median value of 38420000. 3 Determine if your.

Cost basis of rental property is based on the numbers you personally entered when you first entered the property into the program the first year you started using the. To calculate the taxes owed when selling the rental property we need to make the following calculations. Ad No Stress Property Tax Appeal - Call Now For Guaranteed Tax Savings.

Capital Gains Capital Gains Tax Selling Price of Rental Property - Adjusted Cost Basis Capital Gains x Tax Rate Depreciation x. The original cost basis of a rental property is the purchase price plus certain closing costs that must be capitalized instead of expensed. Selling price selling costs adjusted basis realized capital gain or loss.

You Report Revenue We Do The Rest. How is step up basis in rental property calculated. If your taxable income is 496600 or more the capital gains rate increases to 20.

You Report Revenue We Do The Rest. The total amount is your taxable income. Tax amount varies by county.

To find the adjusted basis. Ad Easily File Your Rental Property Taxes. 074 of home value.

Calculating capital gain on rental property. 1 Use the date of death as your step up date.

How To Calculate Rental Income The Right Way Smartmove

2

Rental Income Tax Rate For Airbnb Hosts Shared Economy Tax

X194mrrdy2zf1m

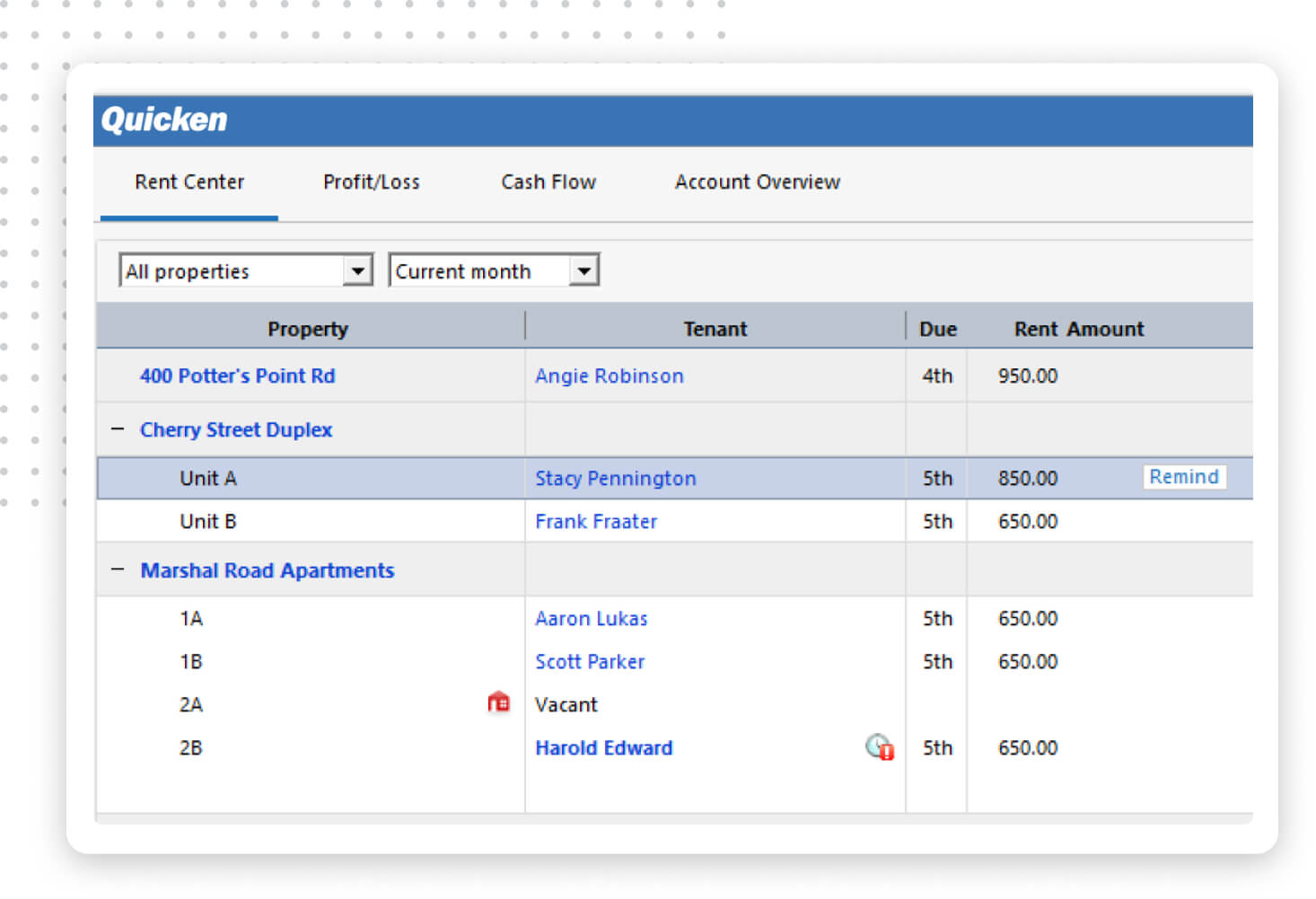

Quicken Rental Property Manager The Easy Way To Manage Your Real Estate

Pin On The Westbrook Realty Group

Tax Benefits Of Accelerated Depreciation On Rental Property

Rental Property Accounting 101 What Landlords Should Know

How Rental Income Is Taxed Property Owner S Guide For 2022

Download Rental Property Management Excel Template Exceldatapro Rental Property Management Property Management Rental Property

Pin On Real Estate Investing

Nauosv L1hk1om

Rental Property Depreciation Rules Schedule Recapture

Like Kind Exchanges Of Real Property Journal Of Accountancy

Pin On Mission Organization

Depreciation For Rental Property How To Calculate

Converting A Residence To Rental Property